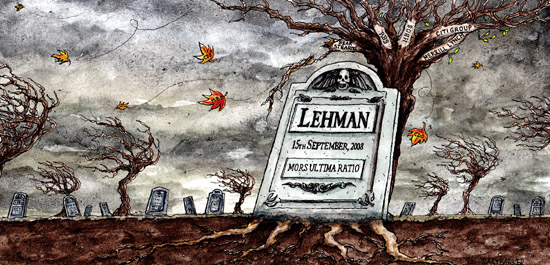

Lehmans Brothers

Established in 1850 and declared bankruptcy in 2008, it was the fourth largest investment bank in the USA.

In 2008 the bank faced huge losses to the sub-prime mortgage crisis and in the second quarter reported a $2.8 billion loss and was forced to sell $6 billion of assets. A report in March 2010 suggested that the bank's executives used cosmetic accounting at the end of each quarter to make its finances appear more sound than they actually were. Using repurchase agreements that temporarily removed details from the balance sheet. However, But these deals created "a materially misleading picture of the firm’s financial condition in late 2007 and 2008."